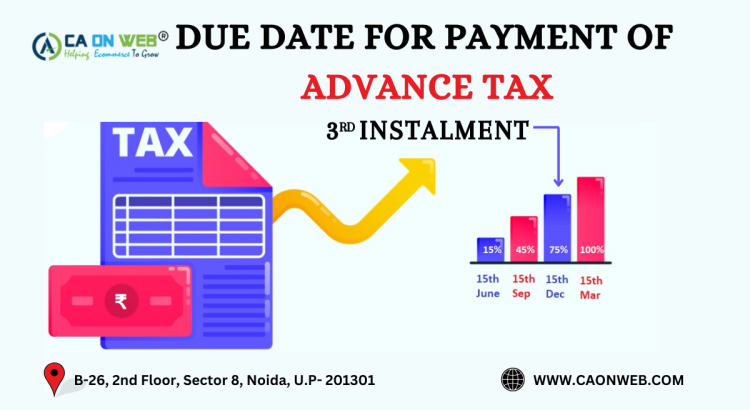

🔊 Play Taxpayers are required to settle 75% of their advance tax obligation by December 15, 2024. Advance tax, commonly called income tax paid in advance for earnings within the same financial year, is an integral part of tax compliance. Often called ‘pay-as-you-earn’ tax, individuals and businesses with a tax liability of Rs 10,000 or […]

Category: TDS filing

FORM 26QB: TDS ON SALE & PURCHASE OF PROPERTY

🔊 Play CONTENTS OF TOPIC S.No. Particulars 1 Introduction 2 Requirements associated with Form 26QB 3 Steps to fill Form 26QB Steps to Download Form 16 4 Illustration on successful filing of Form 26QB 5 FAQs 6 Conclusion 7 Expert Insights Introduction to 26QB Under Section 194-IA of the Income Tax Act, 1961, when […]

NEW TDS RATES EFFECTIVE FROM 14TH MAY 2020. HERE IS THE LIST OF MOST COMMON HEADS!

🔊 Play File TDS Return Online SECTION NATURE CURRENT (TILL 13TH MAY) RATE EFFECTIVE FROM 14TH MAY 2020 TO 31ST MARCH 2021 194 J Payment of Professional Fees etc. 10 % *in certain cases like royalty, technical service fees rate is 2% 7.5 *in certain cases like royalty, technical service fees rate is 1.5% 194 […]